Key points

- While 2022 was challenging, with both global equity and fixed income markets falling in tandem, the future may bring higher expected returns but also higher volatility.

- We believe that investors should consider five ways to adapt to the new investment world. We explain each of these in detail in the following article.

- We believe that a well‑managed, well‑diversified multi‑asset strategy could be an efficient one‑stop solution to potentially benefit from all five suggested approaches.

Introduction: 2022—A Difficult Year for Investors

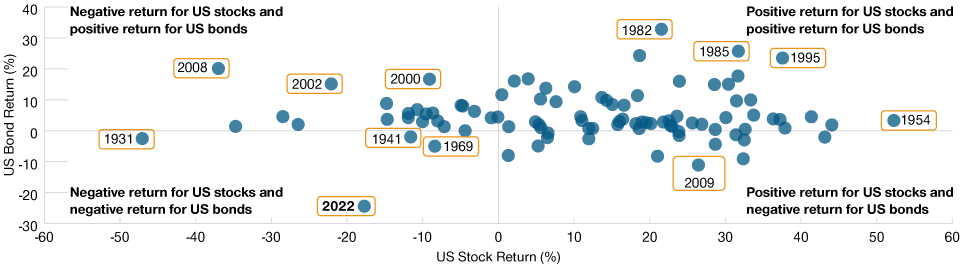

This year has been disappointing for investors in public markets. Equity and fixed income investments across the globe have fallen sharply after strong returns, particular to equity markets, leading up to and after the coronavirus pandemic. What made 2022 especially challenging was that both equity and fixed income markets fell in tandem, making it very difficult to diversify portfolios. Figure 1 illustrates this, using returns of US equities and US Treasuries for calendar years since 1928. This year is a clear outlier in a historical context.

Calendar Year Total Returns of the S&P 500 and US 10‑Year Treasury

(Fig. 1) For the period 1928 through 2022 (to 30 September)

As of 30 September 2022. Past performance is not a reliable indicator of future performance. Based on annual total returns measured in US dollars (USD). Sources: S&P 500 Index and US 10‑year Treasury (see Additional Disclosures). Analysis by T. Rowe Price.

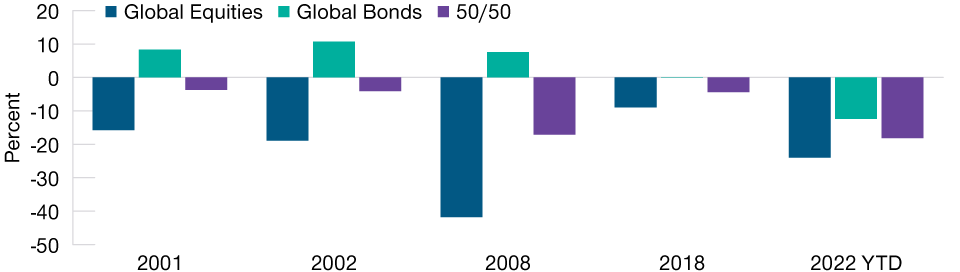

Figure 2 highlights the five worst years since 1992 for a portfolio of 50% global equities and 50% global bonds. We consider portfolios made up solely of global equities and global bonds, represented by the MSCI All Country World Index (ACWI) measured in sterling (GBP) and the Bloomberg Global Aggregate Index hedged to GBP, respectively, throughout this paper. While many other investment types are possible within a multi‑asset portfolio, we believe the overall findings would be generally similar.

Returns of Global Equities, Global Bonds and a 50/50 Mix

(Fig. 2) For selected years 1992-2022

As of 31 October 2022. Past performance is not a reliable indicator of future performance. Global equities—MSCI ACWI in GBP, global bonds—Bloomberg Global Aggregate Index hedged to GBP.A 50/50 mix portfolio is assumed to rebalance annually. Sources: Index data sourced from Bloomberg and MSCI (see Additional Disclosures). Analysis by T. Rowe Price.

It is noticeable that the losses on such a supposedly ‘balanced' portfolio in 2022 would have been close to those seen in 2008 during the depths of the global financial crisis. Unlike other difficult years, the decline in 2022 hit both global equities and global bonds.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.