Key Insights

- A strong dollar, disappointing earnings growth, and slowing global growth make the outlook for emerging market equities challenging in the short term.

- Those same headwinds, however, are likely to become tailwinds as we move through the next stages of the economic and equity cycle.

- Emerging market equities have historically been an early beneficiary of global economic recoveries. Any improvement in economic conditions may represent a signal to increase allocations to the asset class.

The global economic environment is highly complex as economic indicators are flashing red, liquidity is being drained from the financial system, and equity market returns have become concentrated in specific areas. Emerging markets (EMs) have also had to deal with distinct headwinds that have hindered performance. To add to this, the yield curve has been inverted for over a year now, raising the prospects of a US recession. (An inverted yield curve has preceded every US recession for the last 50 years.)

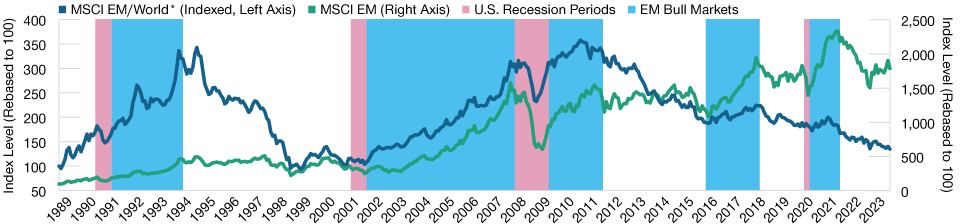

Emerging Markets Equities Have Typically Been Early Beneficiaries of Economic Recoveries

(Fig. 1) EM equities have historically outperformed coming out of U.S. recessions

As of August 31, 2023.

Past performance is not a reliable indicator of future performance.

*Blue line represents MSCI Emerging Markets Index performance versus the MSCI All Country World Index.

Sources: National Bureau of Economic Research, FactSet. Financial data and analytics provider FactSet. Copyright 2023 FactSet. All Rights Reserved.

At first glance then, it may not seem like the ideal time to be considering allocations to EMs, particularly given their reliance on global trade and exports. However, we believe specific turnaround factors are beginning to form. In addition, if we witness a short or mild recession that many economists are predicting, then EMs may be well placed to deliver as they have historically been early beneficiaries of economic recoveries (Figure 1).

Headwinds Likely to Turn to Tailwinds

There is no argument that EMs have performed poorly versus developed markets in recent years. A strong US dollar, geopolitical tensions, disappointing earnings growth, and a narrowing of the economic growth premium versus developed markets weighed heavily on sentiment. More recently, deglobalization trends—with greater protectionism and onshoring of production—have also worked to limit growth. However, looking further out, those same headwinds could become potential tailwinds as we move through the next stages of the economic and equity cycle. With compressed valuations, a weakening US dollar, peaking inflation in many emerging market countries, and the potential for interest rate cuts, the ingredients for early stages of recovery are forming.

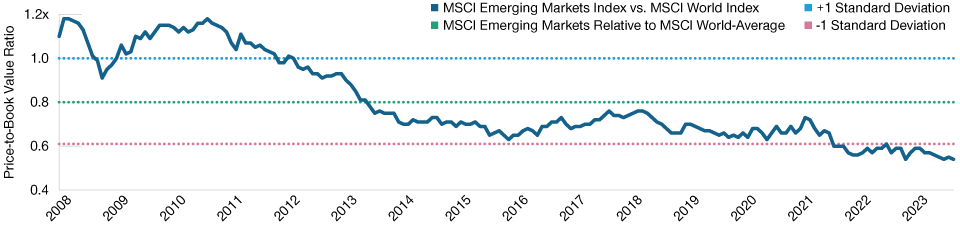

Valuations are particularly attractive relative to other markets. In terms of price‑to‑book, EM valuations have fallen to 1 standard deviation below historic levels (Figure 2), offering both opportunity (in terms of recovery) and further downside mitigation (as we head into a possible recession). Meanwhile, EM earnings estimates have already been marked down sharply, but we expect these to rebound as the global economy bottoms and then recovers.

Valuations Are Looking Attractive Versus Other Markets

(Fig. 2) Price‑to‑book valuations are close to historic lows

January 1, 2008 through August 31, 2023.

Source: FactSet. Financial data and analytics provider FactSet. Copyright 2023 FactSet. All Rights Reserved.

The Outlook Shows Promise, but Expect Bumps Along the Way

The path toward recovery is unlikely to be smooth, however, and the experience across EM countries will vary. Economies such as China, India, and Brazil, with strong domestic demand potential, are better placed to weather the challenging environment. China remains a conundrum, and even though the reopening of China following the extended COVID restrictions initially spurred investment, more recent data have been disappointing. Similarly, the underperformance of Chinese equities relative to their global counterparts year‑to‑date also reflects disappointing momentum.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.