Highlights

- August was a relatively quiet time for fixed income markets after several months of volatility. Inflation and growth were key themes, as markets digested mixed signals.

- Developed market yield curves steepened in August, with yields rising more at the long end, reinforcing the idea that central banks may have to keep interest rates higher for longer.

- In credit markets, investment-grade spreads widened in August for the first time in months, reflecting a change in investor sentiment amid growth concerns.

August was a relatively quiet time for fixed income markets after several months of volatility. Inflation and growth were key themes, as markets digested mixed signals. On the one hand, economic activity in developed markets showed signs of softening and inflation in the US, UK and euro area broadly fell, although the rate of decline continued to disappoint central banks. Meanwhile, labour markets remained tight, especially in the euro area, where unemployment hit a record low of 6.4% in July. The US unemployment rate rose slightly to 3.8%, but this was likely due to an increase in the number of people entering the workforce rather than an uptick in job losses, amid resilient consumer demand.

Ratings agency Fitch downgraded its rating of US government debt from AAA to AA+, citing concerns over the US's debt burden. However, the move had a limited impact on US Treasuries.

Monthly performance by market

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Bloomberg. For the period 31 July 2023 to 31 August 2023. Bloomberg indices are used as proxies for each exposure.

Government bonds

Developed market yield curves steepened in August, with yields rising more at the long end, reinforcing the idea that central banks may have to keep interest rates higher for longer. In the US, 2-year Treasury yields fell by 1 basis point (bp), while 10-year Treasury yields rose by 15 bps. In the UK, 2-year gilt yields rose by 15 bps and 10-year yields by 5 bps; yields rose most sharply at the very long end of the gilt yield curve, with 40-year yields rising by over 30 bps. In Europe, 2-year yields fell by 6 bps, while 10-year yields fell by 2 bps.

Credit markets

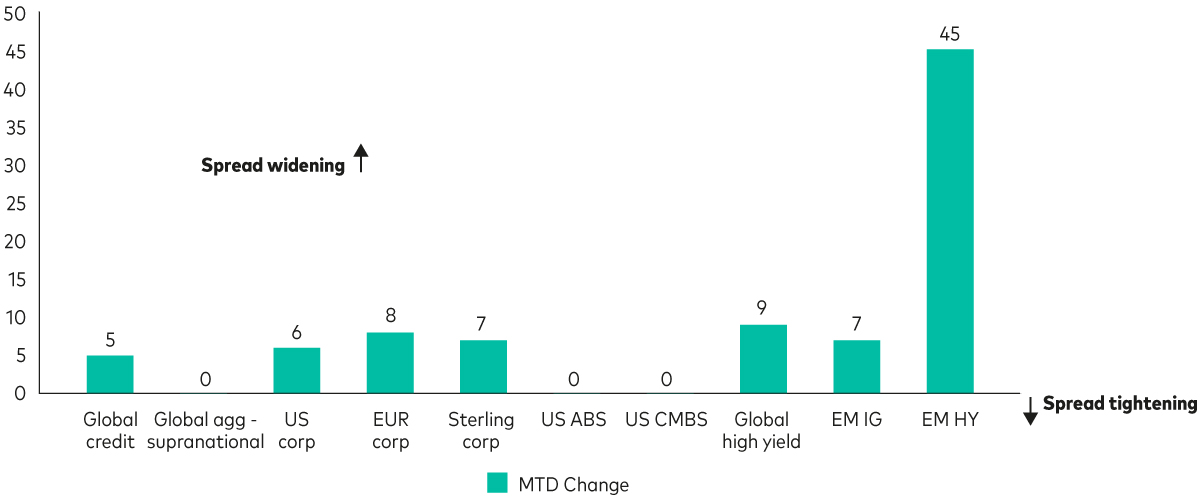

In credit markets, investment-grade spreads widened in August for the first time in months, reflecting a change in investor sentiment amid growth concerns. Investment-grade spreads in the US, UK and euro area widened by 6 bps, 8 bps and 7 bps, respectively1. In emerging markets (EMs), high-yield spreads widened by 45 bps (the largest spread movement among all credit sub-asset classes over the month), while investment-grade EM spreads widened by 7 bps.2.

Changes in spreads

Source: Bloomberg indices: Global Aggregate Credit Average OAS Index, Global Aggregate Supranational Index, US Aggregate Corporate Average OAS Index, Euro Aggregate Corporate Average OAS Index, Sterling Aggregate Corporate Average OAS Index, US Aggregate ABS Average OAS Index, US Aggregate CMBS Average OAS Index, Global High Yield Average OAS Index. JP Morgan EMBI Global Diversified IG Sovereign Spread Index, JP Morgan EMBI Global Diversified HY Sovereign Spread Index. Data for the period 31 July 2023 to 31 August 2023.

Corporate new issuance in August remained low, with €31 billion of euro-denominated and £4.4 billion of sterling-denominated issuance. Strong expected supply in September acted as a headwind, and we are yet to see strong flows into investment-grade credit. As we approach the end of the rate hiking cycle over the next six months, we expect flows into investment-grade to stabilise and the technical backdrop to improve.

Emerging markets

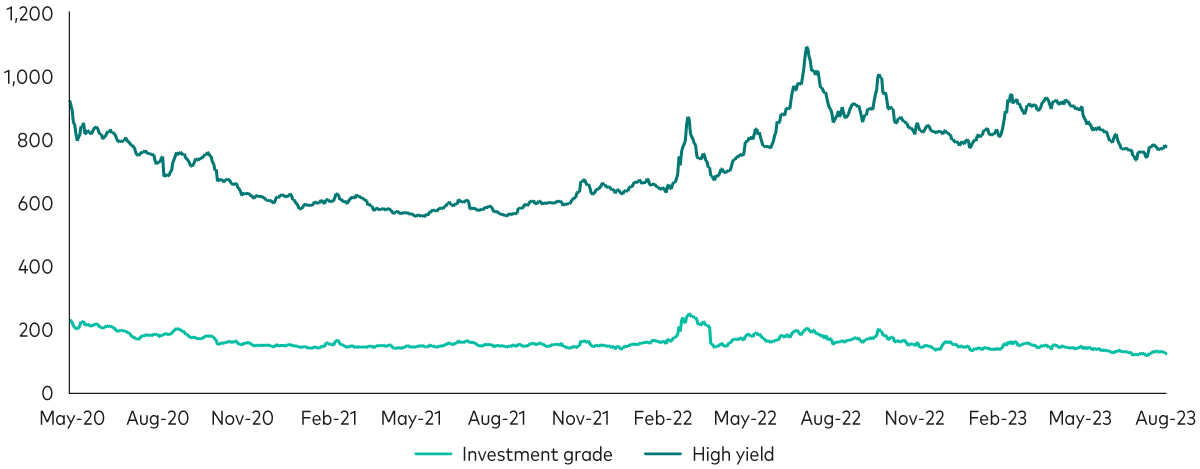

EM credit markets posted their first month of negative returns since February, falling 1.5% in August. EM index-level average spreads grew 25bps wider, giving back half of their total tightening since the start of the year3.

The sell-off was driven in part by expectations of third-quarter new issuance, and was compounded by waning global risk appetite amid concerns around Chinese economic growth and rises in US real (and nominal) yields. EM investment-grade bonds underperformed high-yield on a risk-adjusted basis due to their higher sensitivity to US Treasuries, which sold off in August.

Emerging market bond spreads

Source: Bloomberg, JP Morgan and Vanguard, 31 July 2023 to 31 August 2023

EM local-currency bonds gave back some of their strong year-to-date performance in August, returning -2.7%4. The underperformance was driven by a sell-off in EM currencies as rising US real yields and softer global risk sentiment fuelled a US dollar rally.

EM technicals deteriorated in August as expectations of a strong September issuance pipeline and hard-currency outflows of $6.7 billion dragged on the market. However, technicals are expected to remain supportive for EM hard-currency debt. EM credit has seen negative net issuance in 15 of the last 17 months. With a record percentage of issuers having already met their full-year funding needs at this point, and many issuers locked out of the market at current elevated funding rates, technicals should remain positive for the asset class.

Outlook

The outlook for global bond markets remains in the balance. We believe investment-grade bonds are one of the most compelling segments at present, with higher starting yields, central banks that are likely nearing the end of their hiking cycles and a weaker global economy that is not yet recessionary. US 10-year Treasury yields also offer an attractive entry point as the US yield curve begins to steepen. In credit, valuations are looking less attractive, although we saw some signs of spread widening in August.

In EMs, we maintain a positive outlook, although valuations, especially in investment-grade EM credit, are starting to look expensive. However, yields remain extremely attractive, and at these levels they have historically been followed by strong returns for 6-12 months. As growth slows, we expect volatility to increase and selection opportunities to become available. While we continue to think EM local-currency bond markets offer attractive opportunities owing to high real interest rates, we will need to see greater clarity in the global monetary policy cycle before we see the next leg of the rally in local EM bonds play out.

Vanguard Fixed Income

Find out more about Vanguard's fixed income capabilities.

1 Source: Bloomberg Global Aggregate Credit Index, 31 July 2023 to 31 August 2023.

2 Source: JP Morgan EMBI Global Diversified Index, 31 July 2023 to 31 August 2023.

3 Source: Vanguard and JP Morgan. Average spread calculations based on the JP Morgan Emerging Market Bond Index (EMBI) Global Diversified Index relative to US Treasuries. Monthly change in spread is for the period 31 July 2023 to 31 August 2023; year-to-date period is for 1 January 2023 to 31 August 2023.

4 Source: JP Morgan EMBI Global Diversified Index, 31 July 2023 to 31 August 2023.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.