Key points

- We attach a 60% probability to a strong reopening for China in 2023, with gross domestic product growth of 5–6% likely achievable.

- China’s sharp reversal of zero-COVID should have the biggest impact on domestic demand. Stimulus policies will be an important element in economic recovery this year.

- We think that the positive impact of China’s reopening on the global economy will likely be moderate. It is unlikely to change the global trajectory on its own.

China's earlier-than-expected economic reopening following the abrupt end of the zero-COVID policy is seen by global strategists and investors as one of the defining events for 2023. In this note we consider two alternative economic reopening scenarios and their implications for (i) China's domestic economy and (ii) the rest of the world following China's dramatic pivot away from zero-COVID on December 7, 2022.

The three scenarios can be summarized as follows:

Scenario 1: Downside case (40% probability) Full/brisk pace of reopening with a cautious consumption response; economic rebound starts in the first quarter of 2023, but momentum takes time to build up as the economy faces headwinds from exports and a continuing drag from housing; likely 4%-5% gross domestic product (GDP) growth. This is lower than the consensus of around 5%.

Scenario 2: Upside case (60% probability) Full/brisk pace of reopening brings about a stronger and quicker consumption response; strong stimulus support from the government helps offset other drags and reignites confidence/optimism; full-year growth still constrained by the weak global outlook, but 5%-6% GDP growth is likely achievable.

Our downside case, Scenario 1, is for the current brisk pace of reopening since December to continue and for this relaxation to be met with a cautious response more broadly, resulting in more notable consumption increase (and rebound in growth) only from the third quarter of 2023 onward. This path takes into consideration the continued weak consumer and business sentiment more broadly and the fact that pockets of the economy have suffered (and continue to suffer) under zero-COVID and that unemployment has become a greater concern. Scenario 1 also attributes a decent amount of growth weakness to negative structural trends versus just COVID effects.

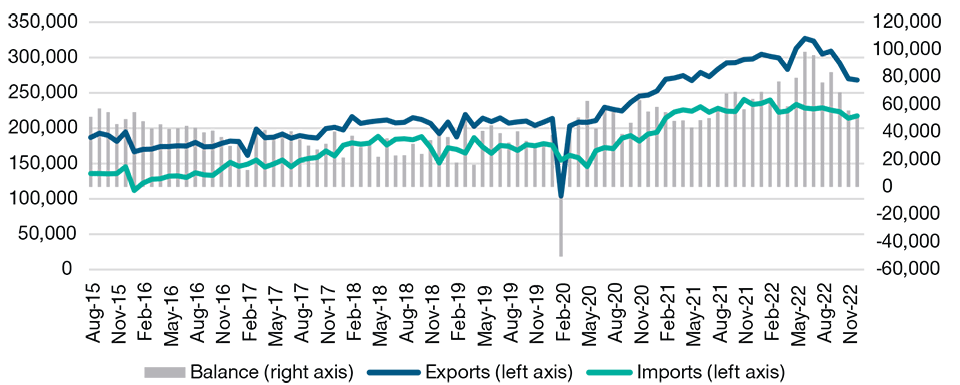

China's Trade Balance May Shrink Rapidly on Reopening

(Fig. 1) Total exports, imports, and trade balance in USD billions

As of December 2022.

Source: Haver/China General Administration of Customs.

Our upside case, Scenario 2, assumes greater optimism by the Chinese population, resulting in a faster spending response to greater mobility. This view takes comfort from the fact that household excess savings have risen notably over the past few years. The next question is where those savings are likely to be deployed. A soft landing in the global economy would also provide some support to net exports. In our view, the difference between 5% and 6% would likely come from an upside surprise to fixed investment on top of consumption, with notable policy support.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.