Peter Rutter, Head of Equities at Royal London Asset Management

How is the volatile global outlook impacting your investment strategy?

Huge macro forces are swirling around in global equities. However, our portfolio construction aims to minimise the impact of macroeconomic volatility on our performance.

In essence, what our funds try to do is allocate our clients' capital to a subset of companies in the investment universe that we believe are superior wealth creators and are attractively priced. But we make sure to combine them in highly idiosyncratic risk portfolios that are very balanced, with low factor and style risk.

Our approach focuses on stock-picking rather than worrying too much about the macro. If we get the stock picking right, which we have tended to do over the last 20 years, we can outperform across multiple market conditions. It doesn't matter if interest rates are going up or down, we're aiming to effectively remove that macro risk from the delivery of the portfolios.

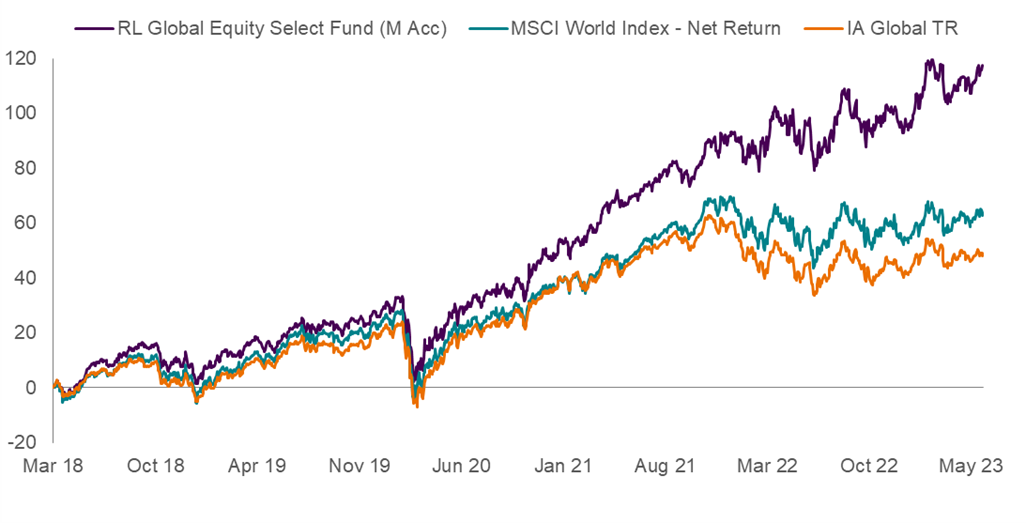

As a case in point, our Global Select portfolio outperformed in 2020, 2021, and 2022 and it's outperforming year-to-date.

Past performance is not a guide to future performance. The value of investments and the income from them is not guaranteed and may go down as well as up and investors may not get back the amount originally invested. Chart shows returns net of fees.

Do you have an example of how you pick stocks?

Yes. Individual stocks can't circumvent the macro economy, but it is possible a portfolio can. For example, Steel Dynamics is a very cyclical steel manufacturing stock in the States that we've owned over the last 5 years that's done exceptionally well. In that same period, we also had the company Eli Lilly, the North American pharmaceutical business which is an incredibly defensive company.

If you think about the contrast, the latter is deeply defensive; when there's a recession, people don't cancel their diabetes medication, it just keeps going and is inflation-protected. When a recession hits, it's bad for Steel Dynamics, but the stock is well positioned for when you get a recovery.

The secret sauce in our portfolio construction is to make sure that relative to the index, we own an appropriate balance of cyclicals and defensives. This means, when recessions or recoveries do occur or there are surprises around economic growth or the lack of it, it has a limited impact on the relative returns of the portfolio.

What is your Corporate Life Cycle approach?

The power of the Corporate Life Cycle approach is that it's something that gives us an edge in picking stocks and building differentiated portfolios. The Corporate Life Cycle concept is the categorisation of all investible corporates into five different groups.

First phase companies include early-stage disrupters and innovative businesses that can be quite loss-making initially but if they're successful, their profits and growth accelerate upwards. Companies then transition to high-quality growth compounders, which is the second phase of the Life Cycle. The third phase is when you get competition impacting from successful businesses and their returns on capital and growth rates then begin to fade. In the fourth phase we have mature companies that are still decent businesses but there's no excess profitability and they grow at or around GDP over the cycle. The fifth phase occurs when business become at risk of being competed away or failing.

The reason why the Life Cycle is such a powerful framework is because we've worked out that you can have good investments in each of the categories. You can have great early-stage growth investments and you can have great turnaround investments when struggling businesses recover. The key insight is that the investment process you need to unleash to pick stocks well is completely different for each category. Effectively we've created five processes in one; there are different ways of generating alpha in each category.

Why isn't everyone doing this?

It's difficult to do. It's taken us 20 years to develop and refine how we select stocks and we're still improving and refining it all the time. Picking stocks across the corporate Life Cycle, particularly when returns are harder to come by, is a challenge.

We're able to do this because of our team. The team includes eleven people with three senior portfolio managers that have worked together for two decades. We go all the way back to the graduate programme at Deutsche Morgan Grenfell!

What separates your approach from other fund managers?

I think what we're doing is quite different because most global equity funds and most fund managers have a particular stance that usually only encompasses one or two of our categories. E.g. They believe in out-and-out disruptive innovative growth or believe in just buying quality growth companies like Nestle, or just looking for very cheap bargains.

Our approach is very different. It says that across the investible universe, all those beliefs are potentially legitimate, but you need to have the right approach at the right time for the right company.

Do you think diversification has become fashionable again?

I think over the past five or six years structurally people undervalued diversification because diversification was probably costing you absolute returns. If you had just stuck it all in a Quality Growth company like Microsoft and gone home, you would have done well.

But then due to macro volatility, rising interest rates and the reversal of falling bond yields post-Covid, suddenly cash and short duration and value started outperforming quite dramatically. I think it's forced people to value and appreciate diversification a bit more.

What have you learnt about fund management over the past 20 years?

There are three things that I think are critical to where we are today. Humility is essential because fund management is a very difficult job, and a lot of things don't work out as planned. You've got to have the humility to say you're not going to get everything right and learn from that.

That links on to the second thing, which is good fund managers and good fund management teams need to be continuously learning. That's deeply connected to humility because you've got to admit that you didn't understand everything as well as you could have done and then refine and improve your process.

The third point is working as part of a team. A cognitive and skills diverse team is way more effective at supporting humility and continuous improvement; and if you work with good people, it's also great fun!

This post is funded by Royal London Asset Management

The value of investments and the income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested.

To find out more about Royal London Asset Management's range of investment solutions please visit www.rlam.com

For Professional Clients only, not suitable for Retail Clients.

This is a financial promotion and is not investment advice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change.

The Global Equity Select Fund is a sub-fund of Royal London Equity Funds ICVC, an open-ended investment company with variable capital with segregated liability between sub-funds, incorporated in England and Wales under registered number IC000807. The Company is a UCITS umbrella fund. The Authorised Corporate Director (ACD) is Royal London Unit Trust Managers Limited, authorised and regulated by the Financial Conduct Authority, with firm reference number 144037.

Issued in July 2023 by Royal London Asset Management Limited, 80 Fenchurch Street, London, EC3M 4BY. Authorised and regulated by the Financial Conduct Authority, firm reference number 141665. A subsidiary of The Royal London Mutual Insurance Society Limited.