In the latest instalment of the ‘Four graphs explaining' series, experts consider Indian equities.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown

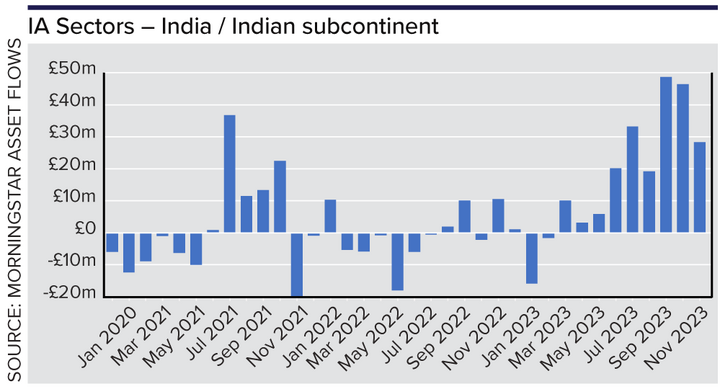

India is top of the pops for retail investors looking for emerging markets exposure at the moment - with several India funds and investment trusts featuring in our most bought on the HL platform in recent months.

The first half of the year was dominated by a binary call - a bar bell approach of money market funds and gilts on one side, tech funds and leveraged US ETFs on the other.

But as the Indian stock market began to rise, outpacing most emerging and many developed market peers, retail investors have taken note, piling into funds from Jupiter and First Sentier as well as trusts from JPMorgan and Ashoka.

There is no doubt that the long-term case for India is compelling. India currently boasts one of the fastest-growing economies globally, with a remarkable 7.6% year-on-year GDP growth to the end of September.

Looking ahead to 2024, the International Monetary Fund (IMF) forecasts robust GDP growth of 6.3%.

The trajectory indicates significant growth in India's middle class over the next few decades.

By 2050, it is projected that India will contribute approximately 40% to global middle-class consumption, a big rise from the current 5% level.

But on a price-to-book basis, India is trading above its average over the previous three decades and above emerging markets including China, Taiwan, and Korea.

So while the economy may be booming, at these prices, investors should be wary of continuing to buy in if they already have ample exposure.