In the latest instalment of the ‘Four graphs explaining' series, experts consider Indian equities.

John Leiper, CIO at Titan Asset Management

The fundamental case for Indian equities is strong.

Prime minister Narendra Modi is pursuing an ambitious growth strategy, and the country is one of the main beneficiaries from firms de-risking their China-focused supply chains.

Internally, the country has a large and insulated domestic market, plentiful labour and a positive political environment, beneficial for attracting foreign direct investment to the country.

Externally, India has room to grow its nascent export driven market via a revitalised ‘Made in India' manufacturing powerhouse.

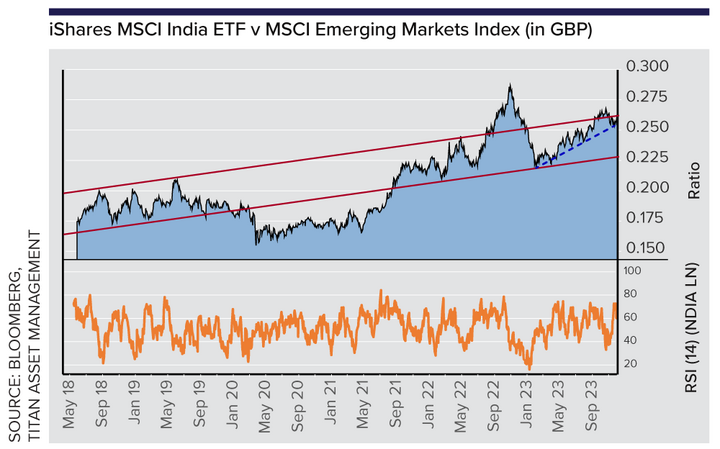

The MSCI India equity index has performed well and is now at the top-end of its range relative to the emerging market benchmark.

We are monitoring relative performance from here.

Near term concerns include ongoing inflation risks, which may constrain consumer spending, and high interest rates which could slow private sector investment and the increasing probability of a US soft landing could mean investors seek higher beta alternatives next year following a strong run in 2023.