In the latest instalment of the ‘Four graphs explaining' series, experts consider Indian equities.

Chris Metcalfe, IBOSS chief investment officer

If you look under the bonnet of the different equity markets during 2023, you will see a wide performance divergence between regions and countries.

Most Indian funds have a very low correlation to any China-related or other global funds, making them a great option to increase diversification within a portfolio, which has been imperative this year.

It still surprises us how few funds are available in India, especially given the size and success of the Indian markets.

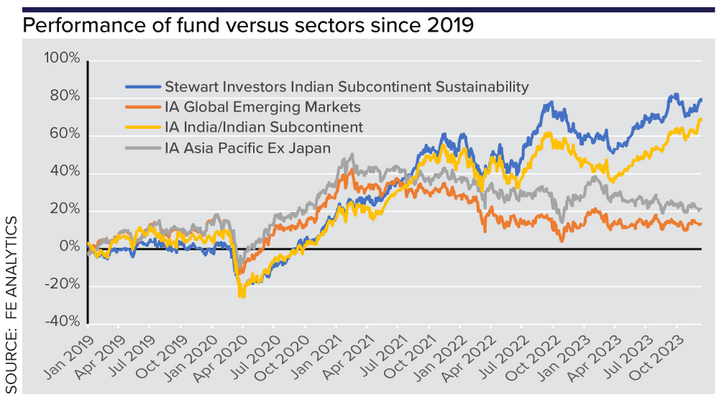

The Stewart Investors Indian Subcontinent Sustainability fund was introduced to our portfolios in 2019 and has been successfully managed by Sashi Reddy and David Gait's team for over a decade.

The fund has had the best Sharpe ratio in the IA India sector over the last ten years, and since we brought it in.

We expect to increase our Indian holdings in the coming quarter, probably by bringing in a second named fund.